What has MFE been up to in the last year?

All Manor of Property – of course!

In 2023, MFE set up Manor Farm Estates Stroud Surveys as a subsidiary dealing with house surveys. The location for this service is restricted to the immediate surrounding area of Stroud and the Five Valleys. We now have a webpage on this site detailing the new offer.

In 2024, it is anticipated that MFE will concentrate more on strategic land. MFE has a new link with tax experts who can advise on inheritance, SDLT and company structures for landowners.

Our prediction for the market in 2024 is, unfortunately, on the gloomy side as interest rates remain high and uncertainty continues with this being a year of elections – not least both in the UK and the USA. There may be a small market bounce of optimism later in the year, as the government tries to ease economic matters in an attempt to secure re-election. This may then feed into a slightly better feel about property transactions but, as these are usually long-term commitments, I don’t think it will be an important factor. Interest rates remain high as compared to recent times and this depresses the market across the board, including all property types.

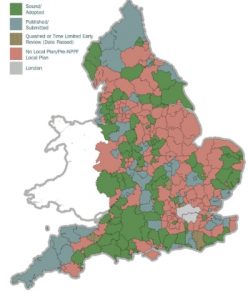

In the planning world, the new NPPF provisions have reinforced the importance of Local Plans so that landowners should engage in this process. A major issue – which MFE can again assist upon – is the question of viability which will eventually be tested in every new local Plan. The implementation of BNG (Biodiversity Net Gain) is a further cost implication for this process.

Good luck for 2024! It is likely to be a bumpy ride!

Within the last few months MFE has achieved sales of just under £2M acting for Dudley Metropolitan Borough Council in carrying forward its programme of surplus asset disposals. Sales have included former care homes as well as disused youth and community centres. In some cases premises have been vacant for years and these will now be re-developed for new uses and new housing so boosting the local economy.

Within the last few months MFE has achieved sales of just under £2M acting for Dudley Metropolitan Borough Council in carrying forward its programme of surplus asset disposals. Sales have included former care homes as well as disused youth and community centres. In some cases premises have been vacant for years and these will now be re-developed for new uses and new housing so boosting the local economy.